Q3 - September 2023

“Yeah, but…”

In many ways, the markets in 2023 have been a reversal of 2022. Utilities, healthcare, and consumer staples, which were last year’s winners, have given ground to the homebuilders, semiconductors, and bitcoin, which were last year’s dogs. The NASDAQ 100 fell -32% in 2022 but it is up 35% in 2023! The only sector within the S&P 500 to see gains both last year and year to date is the energy sector, while real estate and bank stocks have continued their declines. The volatility happening in the equity markets is occurring while the bond market’s total return is negative again, after its historic losses in 2022¹.

The economy’s script has been challenging to read, with more cross currents or what we would describe as “yeah, but” observations. Oil prices jumped more than 28% in the quarter, but growth expectations in Europe and China have moved lower. Existing home sales are down to the lowest levels in decades, but national home prices returned to gains in August. Employment data remains resilient, but banks are tightening their lending standards, and the small business optimism survey is sitting near decade lows. Delta airlines is expecting their capacity to be up 16% this quarter, but the rails, UPS and FedEx have been moving less volume for over a year! We can explain each of these conflicting or confusing trends, but we recognize that there are a lot of mixed signals.

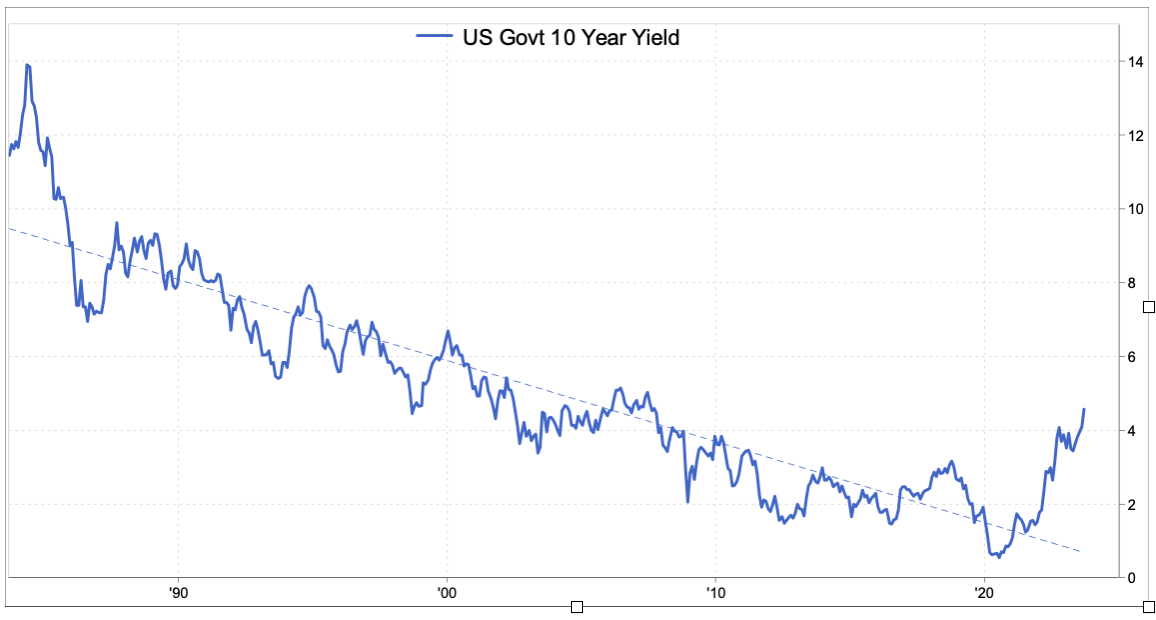

The two big economic stories have been the deceleration of inflation, and the rising interest rates. The 10-year Treasury yield rose by nearly 90 basis points during the 3rd quarter and touched its highest level since 2007. Last year, we saw inflation rise above 8% and interest rates rose, so you might think that slower growth and inflation dropping below 4% would have resulted in lower interest rates. A year ago, expectations were that activity and inflation would be lower today, and a recession in ’23 was almost consensus, so it has been a case of an upside surprise at the macro level. There are several other factors causing the higher rates including the volume of new issuance of bonds from the Treasury, other countries monetary policies and their demand for our bonds, and let’s not forget that Fitch lowered the US’ debt rating in August. Regardless, the Fed has sounded more hawkish of late, and there is a rising view that a no-recession soft landing is more likely. With both the market and various economic data points providing mixed signals, we appreciated the humility of Chairman Powell who said at their August retreat in Jackson Hole, “we are navigating by stars under cloudy skies.” The events of 2020 and 2021 created unique waves still being felt here in 2023, but we continue to avoid arguing with history. Expansions or rebounds in the economy do not typically START after inflation has risen substantially, after banks have tightened lending standards, after the Fed has inverted the yield curve, or after the unemployment rate fell below 4%. Something else tends to occur first. This perspective has kept up cautious, but we also recognize that no two cycles are identical, and this one is proving to be unique.

Deficits Matter, maybe

Years ago, my wife and I attended a lecture from a Stanford professor who was an expert on kids and schooling. She spoke about the pressures kids are under these days from social media, competitive sports, and the college application process. This pressure, she said, has resulted in more cheating in school by more and more “good” kids to the point that it has become pervasive and, in some ways, unpunished as teachers and parents are sympathetic and don’t want to see their kids’ grades suffer. When I think about the deficit spending in Washington, I think there are some similarities to the issue of kids cheating in school these days. Our elected officials are under a lot of pressure to do a lot, which in Washington means spending more and more money. To fill the void, our Treasury must issue more and more bonds to make up for the overspending.

Deficit spending is not morally wrong like cheating, but most of us would agree that consistently spending more than you have is not right, and if there are no consequences to a wrong, why would we expect a bad behavior to change? In a way, the Federal Reserve has acted like a teacher or parent who wants his students to get good grades, so he looks the other way or even facilitated the bad behavior. For years, the Fed has bought trillions of our bonds with the objective of keeping rates lower to encourage economic growth. Interest rates have stayed low, thus eliminating any negative consequence of the overspending by Washington. This is the basic thesis of Modern Monetary Theory, which was introduced more broadly by economist Stephanie Kelton in her 2020 book, The Deficit Myth. The thinking is that the US should not shy away from deficit spending, because there is no negative consequence, so it is not wrong.

Today, the teacher or parent has stopped looking the other way, in that the Fed is no longer buying up a substantial portion of the newly issued bonds, and for several other reasons, the cost of financing is up. Might this negative consequence change the behavior? If so, will there be costs to this discipline? We shall see.

As always, we look forward to speaking to you about your individual account, and we welcome any questions you might have. Our priority is serving you as best as we can, so if there is anything that you need from us, please do not hesitate to ask.

Tyler Pullen, CFA

Portfolio Manager

¹ The Bloomberg US Aggregate Bond Index total return was down -1.21% for the year, as of 9/30/2023, and it declined -13.01% in 2022. The Nasdaq 100 was down -32.38% in 2022 and is up 35.37% All other sector and industry return figures are sourced from FactSet.

Chart source: FactSet

Past performance does not guarantee future results. Market conditions can vary widely over time and can result in a loss of portfolio value. In accordance with the rules of the Securities and Exchange Commission, we notify you that a copy of our ADV, Part 2A and 3 filings with the SEC is available to you upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this list.