Q1- January 2026

Stories of 2025

While we brushed bear market levels in the spring, both the big cap S&P 500 and small cap Russell 2000 indices notched their 3rd consecutive year of double digit gains, each finishing the year with a +2% quarter. The market’s direction was largely driven by continued leadership within the tech sector and the development of AI, but there were plenty of “good stories” elsewhere, and some of the mega names lagged. Artificial intelligence continues to be compared to the railroad and the internet in terms of its implications for our future, but the cost to develop it is approaching or possibly passed the silly zone. Google, Meta, Amazon, and Microsoft have devoted significant resources to this venture. Collectively, they are spending $382 billion on capital investments in the current fiscal year, which is up more than 140% from two years ago². Relative dollars spent on the effort is already dwarfing those other historic initiatives and it almost single handedly supported aggregate economic growth in 2025. The AI spend is estimated to have contributed 40%-45% of US GDP growth over the last three quarters, up from less than 5% in the first three quarters of 2023¹.

While tech outlays are booming, the rest of the economy slowed and with it, the once red hot employment picture has cooled. While the government shutdown silenced the reporting of facts and figures for months, the reliable ADP monthly jobs report showed contraction within the private labor force in 4 of the past 7 months. The three-month moving average of total job growth, excluding healthcare, is now negative for the first time outside of recession in more than 25 years².

The market and the economy were thrown a curve ball by the tariff (aka tax) announcement in early April. The S&P fell more than 18% from its February high, only to rocket higher by more than 9% on the 9th of April when the administration paused the implementation of many of their plans. This was the single biggest daily gain for the market since the depth of the Great Financial Crisis in 2009. Much of the tariff shock and awe was walked back throughout the year, as deals were made and exemptions were handed out, but higher prices or expenses associated with importing goods into the US remain a problem or hurdle for many businesses. Despite worries around the tariffs, the weaker job’s picture and a softer housing market did help to slow the measures of inflation. This allowed the Fed to cut interest rates three times in the 2nd half of the year, which awoke the more rate sensitive side of the market. The 10-Year treasury yield peaked in January around 4.8% and finished the year below 4.2%, and the average 30-Year mortgage rate followed a similar path, dropping from 7.3% to 6.4%³.

Why the Trump administration was using tariffs was one of the most frequently debated questions of the year. Was it to spur or incent domestic manufacturing, was it to generate tax revenue, or was it just a negotiating tactic? I think we found that all three were priorities, but achieving all three will be challenging. The initial announcement and the quick changes clearly got everyone’s attention and brought many countries to the bargaining table. What is less clear is the shift to reshore more manufacturing, but even in an optimistic scenario, this will take time and some policy consistency and clarity. The biggest surprise was not how and why tariffs were utilized, but the lack of significant inflation triggered by the tariffs. While much of the tariffs were paused or reduced, businesses have shifted their sourcing remarkably fast, and the additional costs for the most part have been absorbed, with just a fraction getting passed along to the consumer. To be clear, the economy is now absorbing goods inflation related to tariffs of more than $30 billion a month, versus decades of consistent goods deflation. Favorably, home prices and rents are off the boil partly due to the current administration’s efforts; gasoline prices are lower with oil down 20% year-over-year. One of the most remarkable events of the year was the bombing of the Iranian nuclear facilities. Not only did it neutralize a present day threat to Israel, but it also disabled or reduced Iran’s ability to influence oil markets. It is also not a coincidence that the administration has focused their attention on several other major oil and gas producing countries, specifically Nigeria and Venezuela, not to mention their efforts to obtain a peace deal with Russia.

Back to the Market

While the mega cap tech stocks continued to dominate the market’s attention, only two of the “Mag 7” outperformed the S&P in 2025, and Google was the only hyperscaler to see its stock perform better than the big cap index. While these giants are still posting strong revenue growth and they all have healthy balance sheets, free cash flow is declining for most of them as they write massive checks to pay for this AI arms race. This coincided with or partially explains the shift in market leadership as the “picks and shovels” of the AI build out or the companies that are going to build and stock the facilities or provide the infrastructure began to stand out in the market. Within our Hybrid Active strategy, Broadcom (AVGO) gained 49% in 2025 as demand for their AI semiconductors and datacenter software sent their free cash flow up 36% YoY in their most recent quarter. Within our Small Cap strategy, the power line equipment provider Performed Line Products (PLPC) saw their earnings climb 35% year-over-year in their 3rd quarter, helping to boost its stock by 61% for the year.

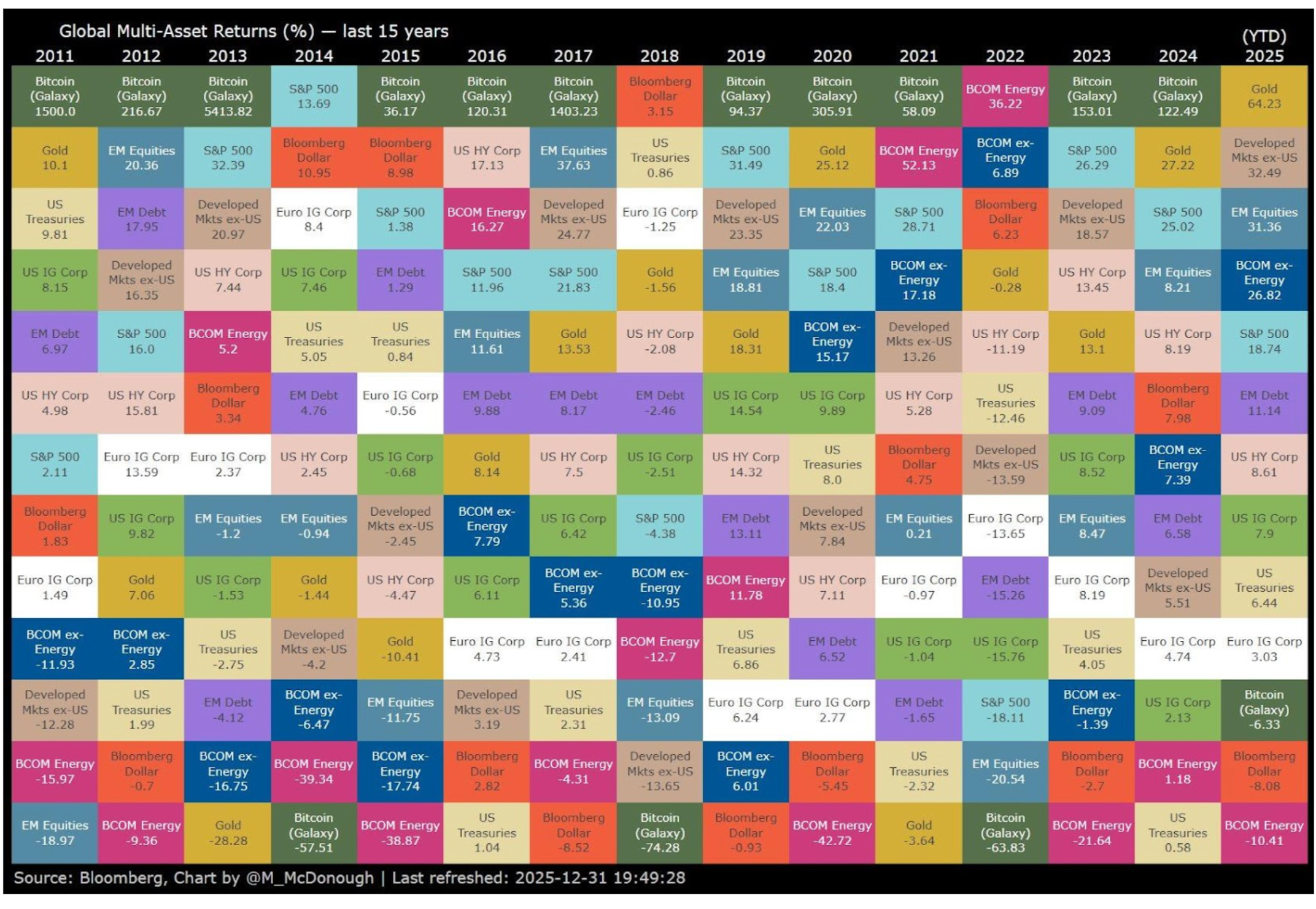

Another notable event within the market was the increase in precious metal prices with gold and silver posting their best year since 1979. Gold rose 64% but silver gained an amazing 141%. The frustrating fiscal picture in Washington did not change much even after the efforts of DOGE. Some geopolitical hot spots cooled while others boiled up; headline inflation slowed, but gold kept rising. On a somewhat related note, the crypto currency story developed a new page with more “treasury companies” popping up or re-branding themselves as such. While we follow this corner of the market, we are not experts in this space. The popularity, size, or attention that crypto currencies receive does provide us with a pulse on speculative animal spirits within the market. There is no denying the positive and very strong correlation between bitcoin and other risk assets, but its volatility is amazing. The table above displays several major asset classes’ annual returns going back to 2011. 2025 was the first year that bitcoin was not first or worst! Over time, these “currencies” might prove to be a wonderful investment or a hedge against inflation, but for better or for worse, Bitcoin’s price has acted just like the NASDAQ, which makes its title as a currency sort of Banana Republic-like. Ironically, there is a cryptocurrency called BananaRepublic!

Looking Ahead

We started 2025 off by commenting on the phrase “American Exceptionalism” and tying it to the general path of the US dollar. At that time, the dollar had a strong 2024, and it was sitting at all-time highs relative to a basket of other currencies. The dollar fell in 2025, posting its biggest drop in eight years. US equity markets performed well, but international equity markets, which have significantly lagged the US market for years, did much better in 2025. Maybe it is relative valuations, maybe it is politics, maybe it is the economy. It is hard to put our finger on the exact cause, but frankly it was good to see and probably a healthy sign. We are entering the 2nd year of a Presidency which tends to be the weakest of the four years for the market. We do have the implementation of the tax cuts and investment incentives associated with the One Big Beautiful Bill (BBB) Act. Favorably, inflation has been fading, and the Fed has been lowering rates. More of the same would be helpful. Slowdowns happen and have at times reaccelerated without rolling into a deeper recession. The number of unemployed remains low, but it is the direction that is concerning. We have had jobless recoveries in the past, and the immigration dynamics are playing a factor, but businesses are hesitant to hire. This leaves the economy dependent on the wealthy to keep up the spending and wealthy mega cap tech companies to do the same in pursuit of their AI dreams. Will the spending and investments continue or will some fiscal discipline set in? These were the main actors in 2025 but will continue to shape the stories of 2026.

Tyler Pullen, CFA

Portfolio Manager

¹Eye on the Market, Cembalest, JP Morgan, 1/1/2026

² The Odds are Changing, Rick Rieder, Blackrock, 01/02/2026

³ FactSet data

Past performance does not guarantee future results. Market conditions can vary widely over time and can result in a loss of portfolio value. In accordance with the rules of the Securities and Exchange Commission, we notify you that a copy of our ADV, Part 2A and 3 filings with the SEC is available to you upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this publication.