Q4 – January 2022

Quarterly Commentary

We finished 2021 on a high note with each of our managed strategies rising in December, capping off a solid year of gains. While we can always provide you with a summary of performance for your specific account, we are also happy to share with you the Fact Sheets and performance for any of our managed strategies.

In our October Commentary, we explained the significance of the inflationary pressures, and we concluded that note with the following statement, “…we have de-emphasized or reduced positions most dependent on low or falling rates. At the same time, we see areas of the economy that are still recovering or companies that are continuing to grow, AND importantly are attractively valued”. In our December note titled, “A Change in the Air”, we talked about the frothy or rich areas of the market, and how many of the more speculative and highfliers of recent years have begun to wobble. The markets finished the year in typical holiday fashion, with the major indices rallying despite the worries associated with the virus, inflation and shifting Fed policy. As of this writing, we are just a week into the new year, but the wobbles that we pointed out in the prior quarter are showing up again and the more rate dependent equities are struggling too. While the Dow 30 and the S&P 500 hit new all-time highs this week, a recent Bloomberg article pointed out that roughly four in every 10 companies on the Nasdaq Composite Index have seen their market values cut in half from their 52-week highs¹. To be clear, none of our managed strategies look much like the Nasdaq Composite.

Those of you who we talk with often know that we are fond to say that “The Macro Matters”. This means that having a good understanding of what is going on with the economy can play a role in the stock selection process. A key element to the economy or the macro environment is the policy of the Federal Reserve here in the US. We therefore talk a lot about Fed or monetary policy because it matters. We are not always making a call on what the Fed is doing, but their policy always has an impact on our portfolio holdings and the market in general, therefore it affects our clients and that matters significantly to us! In our view, the Fed’s impact on the market today is greater than ever before.

The Fed’s 2014 to 2018 rate hike cycle and changes to their bond holdings were well telegraphed and arguably very slow, which in hindsight proved to be fine given the sluggish recovery after the Financial Crisis and the very low inflation. The Fed started to taper its bond purchasing in January of 2014, but it continued adding to its holdings for 10 months. The first rate hike occurred in late 2015, well after they had stopped adding to their portfolio of bonds, and they only moved rates up to 0.5%. It was then a whole year before they raised rates again. Fast forward to the present, after just deciding to begin the current tapering process one month prior, Fed officials signaled at their December meeting that we could see three quarter-point hikes in 2022. Actions matter more than words, but that would imply a significantly quicker tightening of policy compared to what occurred 8 years ago.

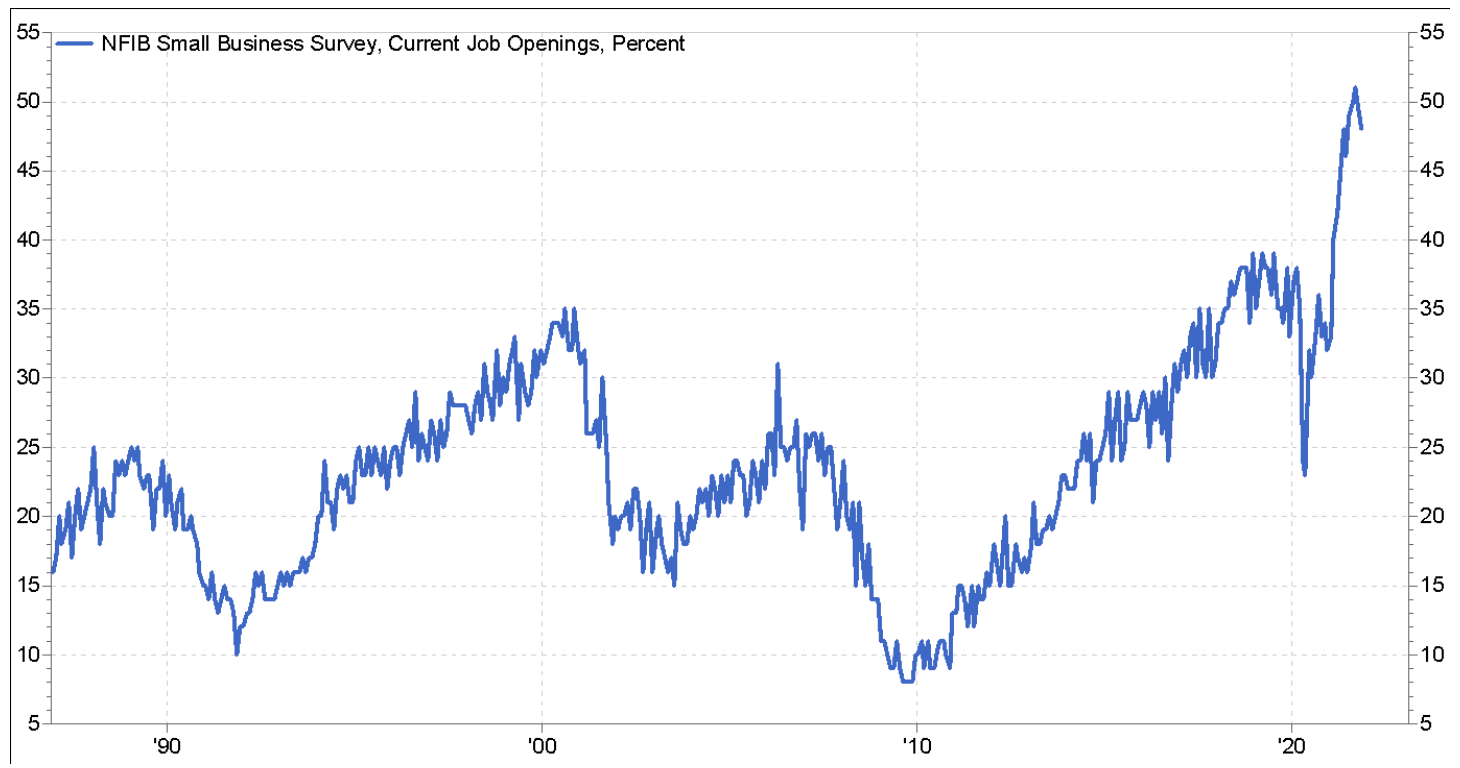

The macro environment is much different today because growth and inflation are much higher, the labor market is very tight, and while rates are as low as they were in 2014, the Fed’s balance sheet is twice as large. In theory, less bond buying from the Fed would mean higher rates. Surprisingly, longer term rates actually fell during 2014 and 2015 despite the Fed’s actions because growth and inflation slowed. China, which had been driving global growth, was having some unique problems around that time and the US had amazingly doubled its oil production in five years’ time. This resulted in oil prices dropping dramatically from $100 to $30 in early 2016, which suppressed inflation. The possible parallels to today regarding China are alarming given their recent real estate issues, which is something we are keeping a close eye on, but the dynamics in the energy market are almost the exact opposite. The number of oil rigs operating in the US is 1/3rd the number in 2014, the Biden administration recently decided to release oil into the market from our country’s Strategic Petroleum Reserve in an attempt to lower prices, and we are seeing extreme supply issues in Europe where natural gas prices have risen to more than 10x what we pay here in the US. The current high growth and inflation could in the end prove transitory, but the Fed appears to no longer expect that outcome.

Tyler Pullen, CFA

Portfolio Manager

¹ Number of Nasdaq Stocks Down 50% or More Is Almost at a Record” Bloomberg, Vildana Hajric, January 6, 2022

Past performance does not guarantee future results. Market conditions can vary widely over time and can result in a loss of portfolio value. In accordance with the rules of the Securities and Exchange Commission, we notify you that a copy of our ADV, Part 2A filing with the SEC is available to you upon request.