Q3 - October 2022

Hey, Mr. President, All your congressmen too

You got me frustrated, And I don't know what to do

I'm trying to make a living, I can't save a cent

It takes all of my money, just to eat and pay my rent

I got the blues, Got those inflation blues

B.B. King Inflation Blues, released in 1983

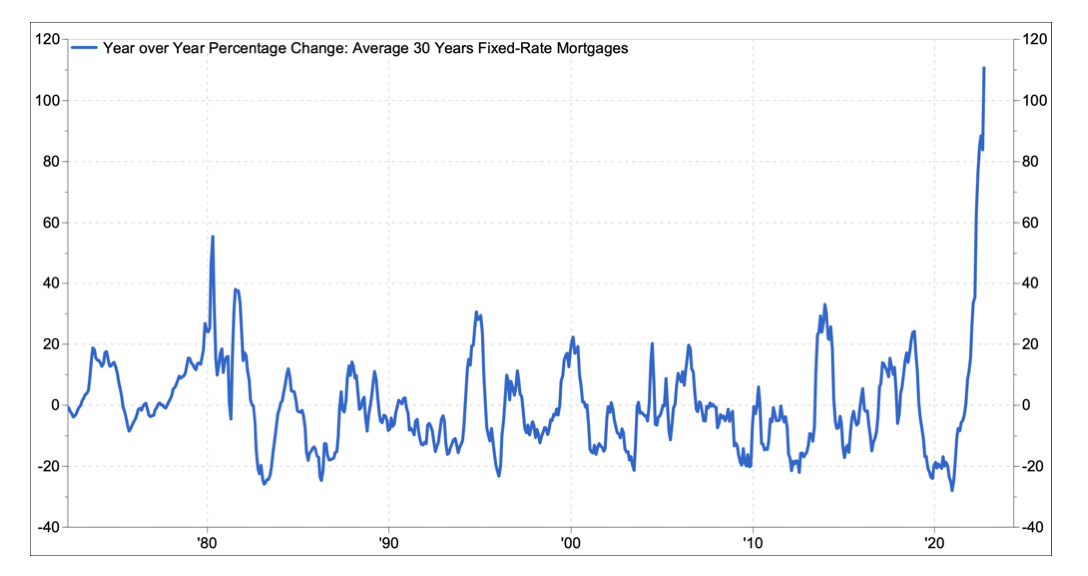

The markets were unfriendly to almost everyone during the third quarter with the S&P 500 closing at the low for the year on Friday the 30th. Bear markets in the stock market are normal and sometimes happen without much headline attention. They are not fun, and they can impact people's lives, but we understand that they happen periodically; however, what we are seeing in the bond market is much more unique, with the Bloomberg Barclay’s Aggregate Index down more than 14% for the year¹. Credit spreads move in and out, and while rates are still relatively low, the recent move is almost in the unprecedented category. The chart below looks at Freddie Mac data for the year over year change in mortgage rates. Now that is a move!

Inflation is the clear issue or reason for the situation playing out in the markets. It is a global phenomenon, it is the result of several factors, it is affecting businesses and individuals, it is evolving, and it has clearly caused a panic among the central bankers who are scrambling to tamp down the once elusive, but now pervasive inflation. The market rally in July and August was driven by hope that inflation would roll over, which would provide cover for the Fed to ease up on their tightening, but that proved premature. The Fed along with other central bankers spent most of September making it abundantly clear that they would not stop until things were back to a normal level. In his August Jackson Hole speech, Chairman Powell referenced prior Chairman Greenspan who defined “normal” as when people and business do not have to factor price changes into their decisions². He also made it clear that inflation was priority one, addressing it will be costly, but the alternative would be worst. In short, the market got the message.

As always, we look forward to speaking to you about your individual account, and we welcome any questions you might have about other holdings. Our priority is serving you as best as we can, so if there is anything that you need from us, please do not hesitate to ask.

Tyler Pullen, CFA

Portfolio Manager

Past performance does not guarantee future results. Market conditions can vary widely over time and can result in a loss of portfolio value. In accordance with the rules of the Securities and Exchange Commission, we notify you that a copy of our ADV, Part 2A filing with the SEC is available to you upon request.